8 Tools To Help You Manage Your Money in 2017

8 Tools To Help You Manage Your Money in 2017

This post may contain affiliate links.

With the new year approaching, this is a good time to review what resources you currently use to manage your money. From pen and paper to apps that communicate to you via text, there are a variety of tools designed to help you save, earn, and manage your money.

This is good news because that means you get to choose the tool that is best-suited to your needs and preferences.

Here are eight tools to help you manage your money in 2017 and beyond.

1. The Personal Finance Planner

Create your monthly budget, track your financial goals, do your weekly meal planning, and create your grocery shopping lists all in one place. The Personal Finance Planner combines the features of a traditional planner with tools needed to create and maintain your monthly budget in a single system. If you lean towards pen-and-paper to manage your budget, you will LOVE this planner!

2. EveryDollar

I am a huge fan of the zero-based budget, and this tool makes it simple to create and follow one. (A zero-based budget simply means that you pre-plan how you’re going to spend every single dollar of the income you have coming in each month. Income – Spending = Zero.) Available to use both on your desktop or as an app, EveryDollar is extremely user-friendly and is a great place to start if you have never tried a zero-based budget or want to ditch your pen and paper or spreadsheets. It is free, or a paid version is available that allows you to link to your bank account.

3. YNAB (You Need A Budget)

Also based on the zero-based budget concept, YNAB is a budgeting tool both for your computer and devices that walks you through the process of ending the paycheck-to-paycheck cycle and actually getting ahead in paying your bills. YNAB is fun and easy to use and connects to your bank accounts and credit cards for an up-to-date view of your money. YNAB offers a free 34-day trial.

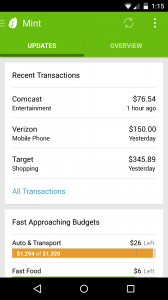

4. Mint

Go beyond just managing your budget with Mint. Free and user-friendly, Mint allows you to manage your budget, bills, and other accounts in one place and across all your devices. This tool provides regular updates on your accounts and alerts you to any unusual changes in your spending. You will also receive regular access to a free credit score.

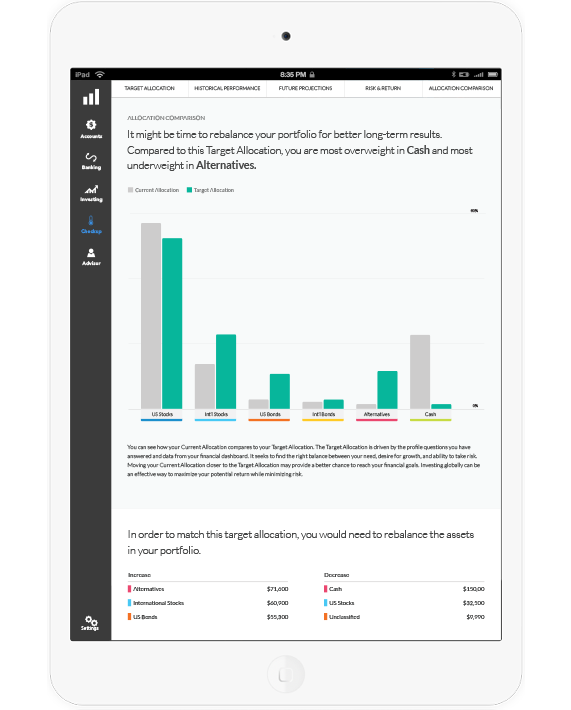

5. Personal Capital

See your entire net worth in one place. Personal Capital is a fantastic all-in-one tool that allows you to manage everything related to your financial picture. By linking all your financial accounts, you can monitor your cash flow as well as manage your long-term investment and retirement goals and gain a clear view of your entire situation. Free to use and available on all your devices, Personal Capital is loaded with helpful tools and calculators.

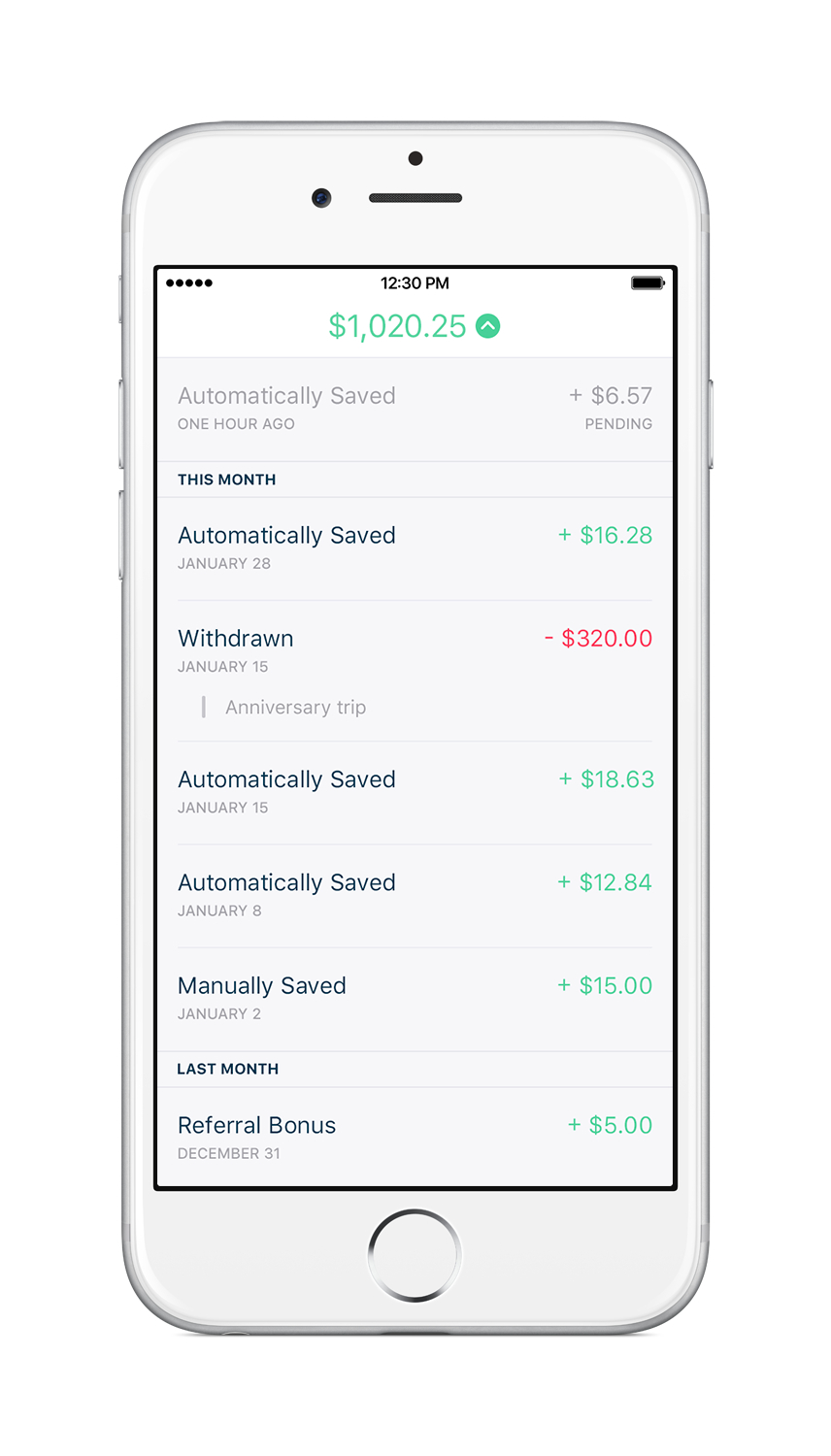

6. Digit

If you need a little push in getting around to saving, try this free app. Digit automates your savings by linking to your checking account, studying your spending habits, transferring available small amounts of money into a savings account, and providing updates via text. Digit is great if you have a hard time making saving a priority and tend to blow your money on other things. You’ll see how saving even small amounts at a time can add up.

7. EvoShare

EvoShare is a free and unique money tool that takes the cash-back concept and does more than just put money in your pocket. By teaming up with specific local businesses as well as some national online retailers, EvoShare takes a portion of what you spend when using your debit and credit cards and puts it into your retirement account or towards your student loan debt. It’s kind of like Upromise for adults. EvoShare has a growing network of businesses they partner with.

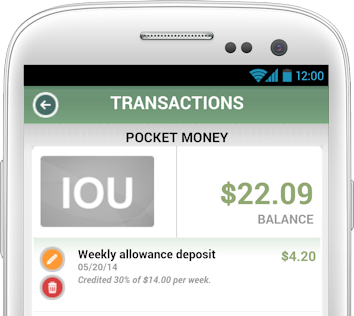

8. FamZoo

There are plenty tools to help you manage your money. What about helping your kids manage their money? FamZoo is a great app for parents looking to teach their children healthy money habits. Through setting up a “virtual family bank,” your kids will learn how to manage and track their earning, spending, saving, giving, and more. Perfect for families with children of all ages, you have the option of allowing your kids to access their money through prepaid debit cards when they are ready. FamZoo offers a generous free two-month trial.

Reviewing your money management tools and perhaps trying out new ones is a great way to start a new year. Explore some of these and give your 2017 a fresh start!

What other tools do you use to manage your money?

Related Reading: 15 Books to Help You Reach Your 2017 Goals

0 Comments