How to Do a Zero-Based Budget

How to Do a Zero-Based Budget

This post may contain affiliate links.

Budget. Did you see that word and want to stop reading this immediately? If so, you are not alone. Many people equate the word budget with restriction or deprivation. In reality, a budget is simply a plan or a guide for your money. And a zero-based budget is a plan for your money that works.

Most people who have tried to budget without favorable results can quickly cite several reasons why budgeting doesn’t work. Their objections to budgeting stem from a misunderstanding of the purpose of a budget.

A budget is NOT intended to rob your life of joy and fun. Rather, its intent is to rid your life of the stress and uncertainty that accompany not having a plan for your money. Have you ever taken money out of the ATM, only to wonder a few days later, where it all went? A budget eliminates that wondering and replaces it with a plan.

What is a Zero-Based Budget?

The zero-based budget is the method taught in The Total Money Makeover as well as in other books written by Dave Ramsey. It is also the method used in the You Need a Budget (YNAB) app and other personal finance websites, books, etc.

The concept is simple. Each month, your goal is to plan how you’re going to “spend” all of your income. Your goal is to get your budget to “zero”. An equation to represent this approach would look like this:

Income – Expenses = Zero

How Does a Zero-Based Budget Work?

- You first figure out how much income you expect to receive in the upcoming month. (Be sure to look at all sources of your income including child support, freelance income, etc.)

- Once you have that number, you spend your income on paper, meaning, you list all your expenses that you need to take care of that month. Keep in mind that “expenses” includes saving. You are deciding ahead of time how you are going to spend every single dollar of your income. Be sure to include every expense, including spending or pocket money.

- You will need to adjust your numbers as you create the budget. If the expenses exceed your income, then you will need to make reductions in one or more category. If the expenses are less than your income, than you’ve got more “spending” to do. You can’t spend more than you have coming in, and you can’t leave any money unaccounted for. This might mean making the tough decision of eliminating or delaying purchases.

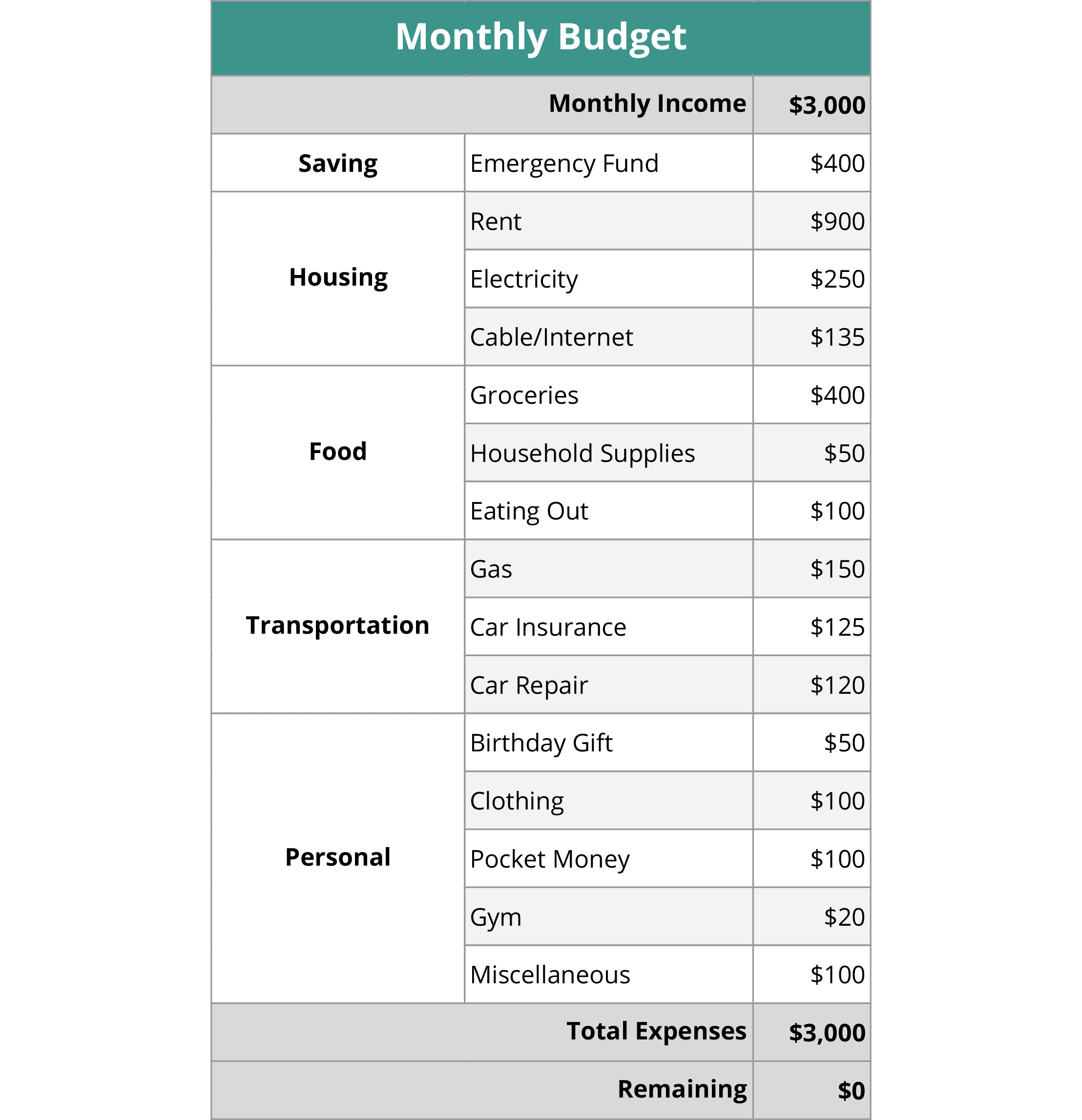

Here is a sample zero-based budget.

The expenses in this budget are equal to the income, to get a result of zero.

Why Does it Work?

- The zero-based method eliminates overspending. You are working only with the income you expect to receive. Nothing more, nothing less.

- You are planning how to spend your money. You are making intentional well-informed decisions.

- You decide what goes into the budget. If you plan to eat out or buy clothes and have the money for it, then put it in the budget.

- Your money goes to the expenses that are a priority. No more running out of money for the things you need because you spent your money on other, less important things.

- Buh-bye guilt. Planning your spending — even your pocket money (hello Starbucks!) — removes the guilt from making purchases.

Tips to Help Maximize Your Zero-Based Budget

- Do the budget BEFORE the month begins. If you’ve already started spending your income, this method will not be effective.

- Do a new budget EVERY month. No two months are the same, and your budget needs to reflect that.

- Be realistic about what you need to spend. Try not to drastically overfund or underfund your categories.

- Give yourself a few months for it to work, especially if this is your first time attempting budgeting at all. Observe what needs to be tweaked as you go along.

- Set aside a reasonable amount to fund a Miscellaneous category.

- Every month, keep a running list of expenses that are coming up next month. These would be expenses that are occasional or out of the ordinary, like purchasing a birthday gift, school pictures, a co-pay for a doctor’s appointment, etc. Having this list when you go to do the budget reduces the number of things that “come up” during the month.

- During the month, track what you spend on things like groceries, entertainment, etc., so you have a better idea how to fund those categories going forward.

Paper or Electronic?

- You can do a zero-based budget on paper, create a spreadsheet, or use an app like EveryDollar or YNAB.

Zero-Based Budgeting Forms

To download your forms and get future updates from Hope+Cents, please enter your email address.

Take it a Step Further

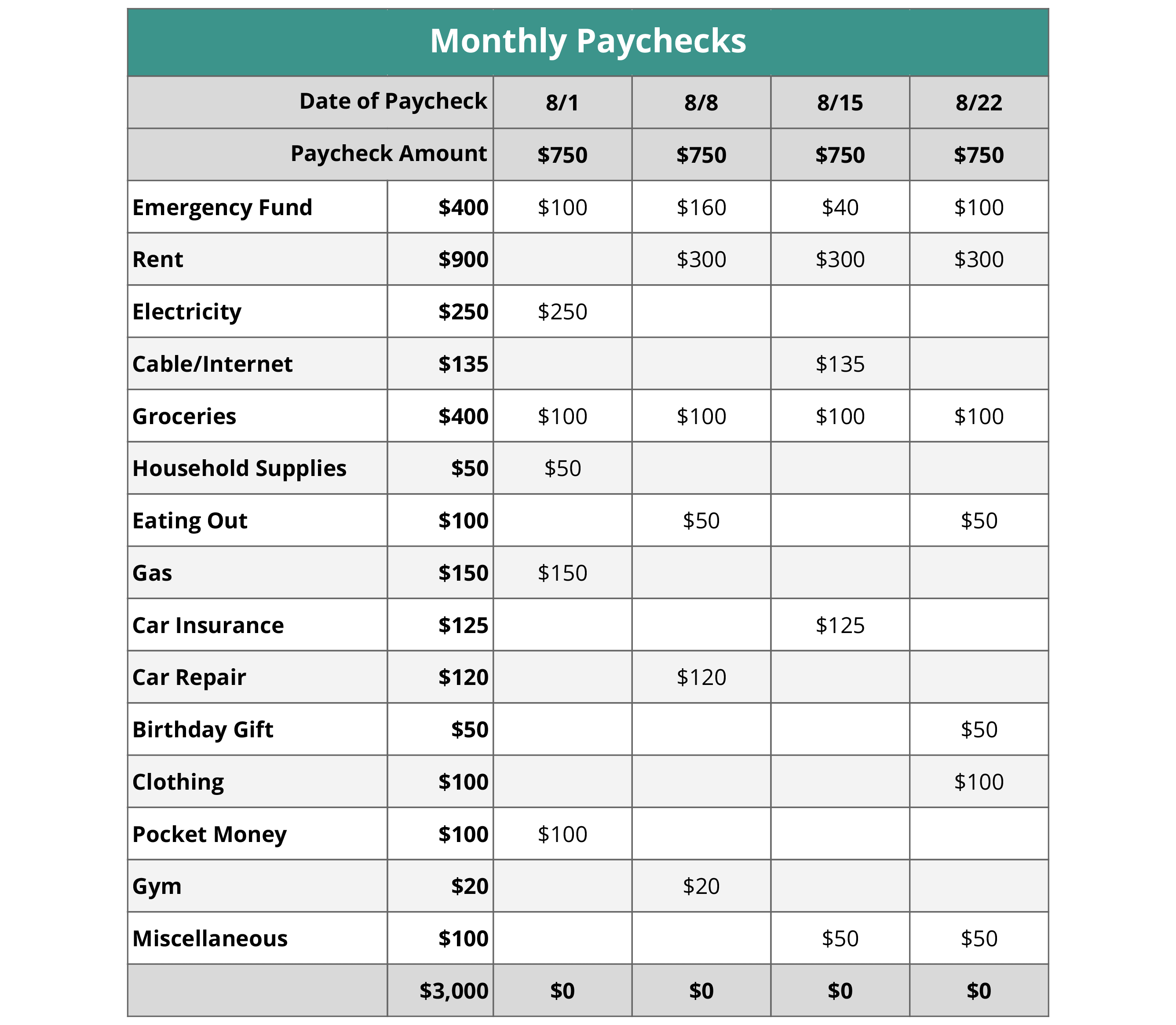

Now that you’ve grasped the concept of a zero-based budget, you can take it a step further by applying this approach to each of your paychecks. After you’ve created the budget for the month, you then look at each pay period for the month and plan how every dollar of that paycheck will be used.

This second step is really what makes the zero-based budget work. It takes the plan and puts action to it.

Based on the sample budget above, this is how those amounts will be spread across four paychecks.

The expenses equal the amount of the paycheck, to get a result of zero.

What if Your Income is Irregular?

If your income fluctuates from month to month, you can still do a zero-based budget. Base your budget on the amount of income you know you will receive at a minimum.

When you have an idea of the income that will come in above and beyond that minimum amount, adjust your budget accordingly.

Give it a Try

If you’ve tried budgeting in the past without success or have never tried budgeting, give the zero-based budget a try. A common sentiment I hear when people try it for the first time, is that they feel like they have more money. I experienced the same when I first started using this method.

Because you are planning your spending and your dollars are going where they need to go, you will “suddenly” realize that you DO have the money to do the things you need to do. You will feel like you have more money. And who doesn’t like that feeling? Give it a try!

Do you plan on trying the zero-based budget? Let me know in the comments.

0 Comments