How to Budget When You Live Paycheck to Paycheck

How to Budget When You Live Paycheck to Paycheck

Are you having a hard time budgeting because you live paycheck to paycheck? While you would like to budget, does it feel like you can barely hold your head above water? Does the thought of carefully planning out your spending and getting ahead seem like a pipe dream? If you feel this way, you are not alone.

Many people, when asked if they budget, respond with something along the lines of, “I don’t make enough money to budget,” indicating that they believe they can only budget when money is flowing freely. Well, the irony of that thinking is the money will never flow freely unless you (you guessed it…) budget.

To break the paycheck to paycheck cycle, your spending needs to be prioritized and managed in a way that there is room to save some of your income, whether it’s for an emergency fund, retirement savings, or for a future vacation or large purchase. You will not wake up one day suddenly having enough money to cover your monthly expenses as well as having some money left over. The only way to get to that point is to budget.

If you have income at all and you have any expenses at all, then you can budget — regardless of how close those numbers might be. You do not need a surplus of money to budget. Everyone — even those living paycheck to paycheck — can budget.

What a Budget Is Not (And What it Is)

Before we get into the how-to of budgeting, let’s explore what a budget is not. Having misconceptions about budgeting is a common reason why people continue to live paycheck to paycheck.

A Budget is NOT a Prison For your Money

Do you want to run the other way when you hear the word, “budget”? This may be due to the popular perception that a budget is all about restriction; it’s all about what you can’t do. No eating out, no shopping, no fun. A budget is a giant reminder of what you’re missing out on.

The opposite is true…

A Budget is a Plan for Your Money

A budget is a map, guide, or plan for how you are going to spend the money you have coming in each month. It is simply an intentional plan for your money.

Will there be things you can’t do sometimes? If there is no money to do them, then yes. But you are in control of your budget. You get to decide and prioritize where your money is going. If you want to eat out and shop and there is money for those things, then put them in the budget.

Your budget will evolve and look different as you progress through your financial journey. While there will be times that everything you want to do with your money can’t be fit into your budget, consistently budgeting will eventually bring you the freedom to do more of the things you want to do.

A Budget is NOT a Perfect Picture of How Your Money Should Be Spent

Don’t get caught up in thinking your budget needs to be an ideal representation of how you should spend your money. If you’re waiting for your financial situation to feel perfect before you budget, then you will always live paycheck to paycheck.

A budget is not intended to represent an ideal.

A Budget is a Reflection of Your Current Reality

Again, a budget is simply a plan for your money, and sometimes that plan is not pretty. If you have more expenses going out than you have income coming in, then your budget will reveal that.

When you don’t budget, it’s easy to have a distorted or unclear view of how you are managing your money. As long as that’s the case, the paycheck to paycheck cycle will never end. Your budget will shed light on the fact that maybe some of your “needs” are wants, and it will force you to prioritize the expenses that must be prioritized.

Steps to Budgeting

Okay, so how do you start budgeting? How do you go from living paycheck to paycheck to budgeting? Well, without sounding patronizing, you just need to start. There is no need to wait for the stars to align. You can start today.

Ideally, you would create your first budget just before the next full month begins, but even that is not necessary. If there are two weeks left in the current month, then create a budget for the next two weeks.

Let’s walk through the basic steps of budgeting.

1. Write it Down

For a budget to be effective, it must be written down. You can also use budgeting tools or software, which we’ll highlight later, but the point is your budget must be documented. A budget cannot be floating in your head. At the simplest form, all you need is paper and a pencil to budget.

2. Start With Your Income

Add up all sources of income for the coming month (or the few weeks you may be budgeting for). If you work, your spouse works, and you drive for Uber, add up everything you expect to receive. Having this total is crucial to the process of budgeting. If your income fluctuates, do your best to estimate what you expect to earn.

3. Gather your Expenses

Now that you know what’s coming in, you need to look at what’s going out. Gather your current statements for all your bills and monthly obligations.

You will also need to know what you spend on non-fixed categories like groceries, spending money, etc. If you have no idea what you typically spend in those categories, a good place to start is to take a look at your bank statements or credit card statements for the last three months and find the average of what you spend monthly.

Next, think about any additional expenses you will need to cover during the month (or again, the partial month, if you are starting mid-month). These are occasional, non-recurring expenses like a doctor’s visit, an oil change, school pictures, etc. Try to think of everything you will have on your plate for the coming month.

4. Spend Your Money on Paper

Going back to your total income that you’re expecting for the month, start “spending” your money on paper. Identify the very first thing you will need to spend your money on, write it down, and subtract its cost from your income. The difference between the two numbers is what you have left to spend.

Then move to the next expense and do the same. Continue going through your expenses, prioritizing what must be taken care of. Do this until you have “spent” all your income. When the income is depleted, you stop spending.

This method is called a Zero-Based Budget: Your Income – Your Expenses = Zero

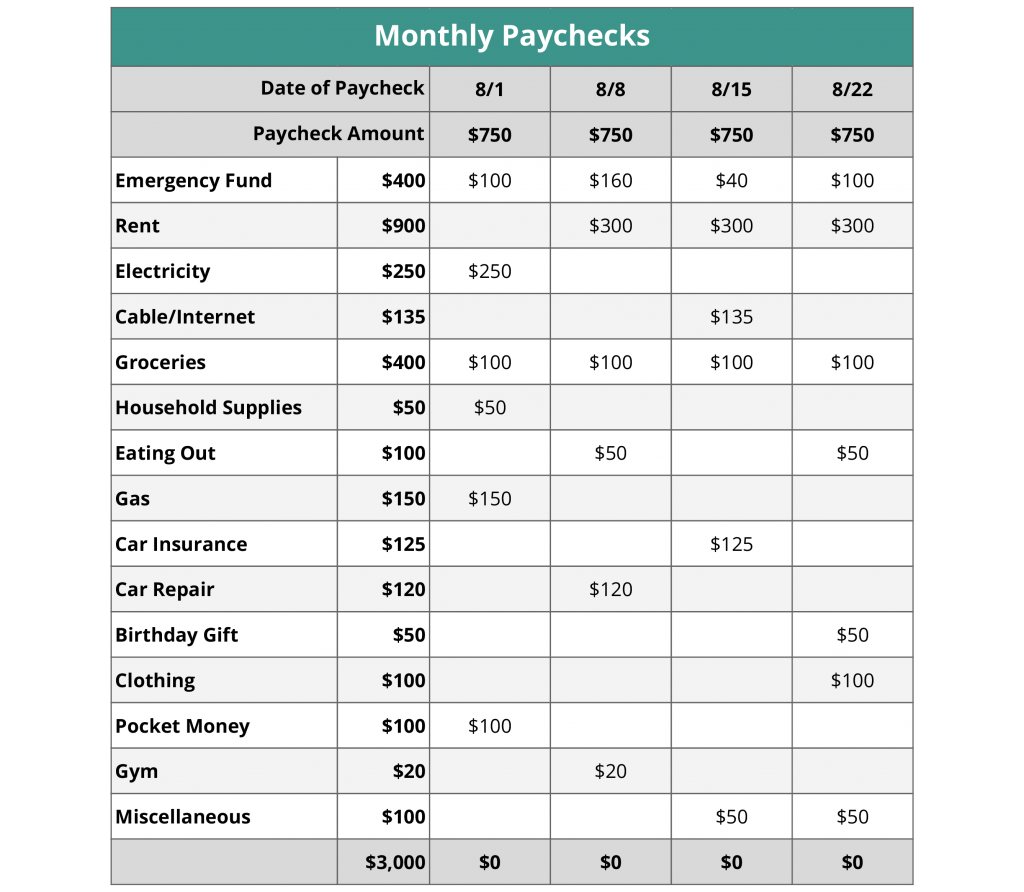

Here is an example of what a Zero-Based Budget looks like.

Ideally, one of your expenses should be saving, however, if you are living paycheck to paycheck and this is your first attempt at budgeting, then your first pass at it may or may not show room for saving. Keep budgeting, though, and you will get there. You will be surprised to learn that prioritizing your expenses results in having more money to do the things you need to do.

5. Plan How You Will Spend Each Paycheck

Once you’ve gotten your budget to “zero,” go back and plan when you will cover all the expenses. List the dates of your paycheck, and the amount you will receive for each check.

Keeping in mind the due dates of your bills, and the fact that you need to eat and put gas in your car each week, repeat the same process of “spending” your income on paper, but this time, you’re doing it for each paycheck. Spend each check down to “zero.”

Based on the example above, this is how those amounts are spread across four paychecks.

This process puts your plan of how who want to spend your money into action. This step of breaking down our expenses by pay period is essential to budgeting successfully.

Related Reading:

• How to Do a Zero-Based Budget

• 5 Common Budgeting Myths

• 8 Reasons Why Your Budget Doesn’t Work

Free Budgeting Forms

To download your forms immediately and get future updates from Hope+Cents, please enter your email address.

What if Your Expenses Exceed Your Income?

If you’ve spent all your income on paper, but there are still expenses left to take care of, you have two choices to deal with the discrepancy: you can reduce your expenses or bring in additional income.

Reduce Your Expenses

Take a look at your expenses again. Are they all necessary? Before you automatically answer, “yes,” think hard and honestly about whether or not all your expenses are needs. You might enjoy the cable package you have, but if you cannot fit it in the budget now, you may need to make the hard decision to reduce or eliminate that expense.

The total sum of your expenses cannot exceed the income you have coming in, so with that in mind, review every single expense and eliminate or reduce the ones that aren’t absolutely necessary. Also, find ways to save on the expenses that are essential.

Related Reading:

• How to Squeeze $500 Out of Your Budget

• A Simple Step to Save Money on Your Monthly Bills

• 15 Expenses You Think You Can’t Live Without…But Can

• 4 Ways to Save at the Grocery Store Without Coupons

Bring in Additional Income

If after reviewing and eliminating your expenses, your income still does not cover everything, then your other option is to increase what you have coming in.

You can do this by finding short-term and temporary ways to bring in more money like selling unwanted items around your home. Or you can consistently earn more income by asking for a raise or overtime at your current job, taking on a second job, or developing a side gig.

Related Reading:

• 50+ Ways to Make More Money When You Work Full-Time

• How to Save $1000 Quickly

• How to Make Money Doing What You Love – Business Boutique Book Review

It comes down to those two options. The bottom line is your income must cover your expenses, so either more has to come in or less has to go out for that to occur. You may need to do some soul searching regarding your situation. If something is completely out of whack, like a housing payment that eats up half of your income or a car payment that is dangerously close to what you pay in rent, then it may be time to let those go.

If you are legitimately struggling, prioritize your expenses in the following order:

- Food (as in essential food to eat at home, not trips to Dunkin Donuts.)

- Rent or Mortgage

- Utilities (again, the essentials here. We’re talking electricity, gas, water, etc. The things you need to survive, not HBO.)

- All Other Expenses

Building a Cushion

So if the goal is to stop living paycheck to check, how does that occur? There are a few things you can do to develop a surplus in your budget that can go towards saving.

1. Continue Budgeting

Usually, it takes about three months to get the hang of budgeting if this is your first pass at it. You will get better at it each month; the key is to stick with it.

2. Track Your Expenses

It’s a good idea in the first few months of budgeting to track your expenses so that you can see how to adjust the amounts you budget. If you see patterns of overspending or underspending, then that will clue you in on what you need to change in your budget.

3. Continue Looking for Ways to Reduce Your Expenses or Increase Your Income.

The same way you need to cut back your expenses or increase your income if you have more going out than coming in, you will need to take those two approaches to develop a surplus in your budget. Each month, look at how you can cut back or bring in additional income.

4. Build a Beginner Emergency Fund

Once you’ve gotten the hang of budgeting and have a little wiggle room in the budget, begin working on a beginner emergency fund of $500-$2500, depending on your income and family circumstances. If you have a cushion to catch the small but inevitable “oopsies” of life, then you prevent yourself from moving from living paycheck to paycheck to living in crisis.

5. Attempt to Get Ahead on Your Housing Payment

After a beginner emergency fund is in place, I recommend focusing on getting one month ahead with your housing payment, meaning, if your rent or mortgage payment is due April 1st, you would use your March income to cover it, not the very first check of April.

Getting to this place will take a little time, but you can get there by using the surplus you have created by slashing your expenses and increasing your income. Ideally, you would work towards getting ahead on all your bills, but having at least your rent or mortgage covered before the month begins will give you a sense of peace that is almost indescribable.

Tools

You do not need a complicated method of budgeting. A budget can be as simple as listing everything on paper, but using tools can also be helpful. There are many to choose from.

Be sure to choose the method that is understandable and works for you. If you find a method complicated, you will eventually abandon it.

Tips

Remember, budgeting will take a little practice. Keep the following tips in mind to increase your chances of success.

- Use cash to help you stick to categories like groceries, entertainment, etc.

- Include “spending money” and “miscellaneous” categories in the budget.

- Get on a “budgeted billing” or similar plan with your utility companies where they average your usage for the year and give you a fixed payment.

- Keep a running note throughout the month of irregular expenses (social events, activities, etc.) that you expect to pay for next month.

- Work on a new budget every month, before you receive your first paycheck of the month.

- If married, work on your budget with your spouse.

- Use any unexpected income or windfalls like a tax return to build your emergency fund or to get ahead in your housing payment.

Budgeting is the Key To Ending the Paycheck to Paycheck Cycle

Keeping in mind what a budget is and what it is not, the fact that you are currently living paycheck to paycheck should not hold you back from budgeting. In fact, budgeting is the key to getting out of the paycheck to paycheck cycle.

Decide today to take these steps towards budgeting. It bears repeating that it will take you a few months of budgeting to get the hang of it. If you commit to sticking to the process and working at it, each month will bring you closer to having breathing room and further away from living paycheck to paycheck.

The key is to start today!

0 Comments