How to Budget When It Feels Like You Have No Money

Figuring out how to budget when you live paycheck to paycheck seems impossible.

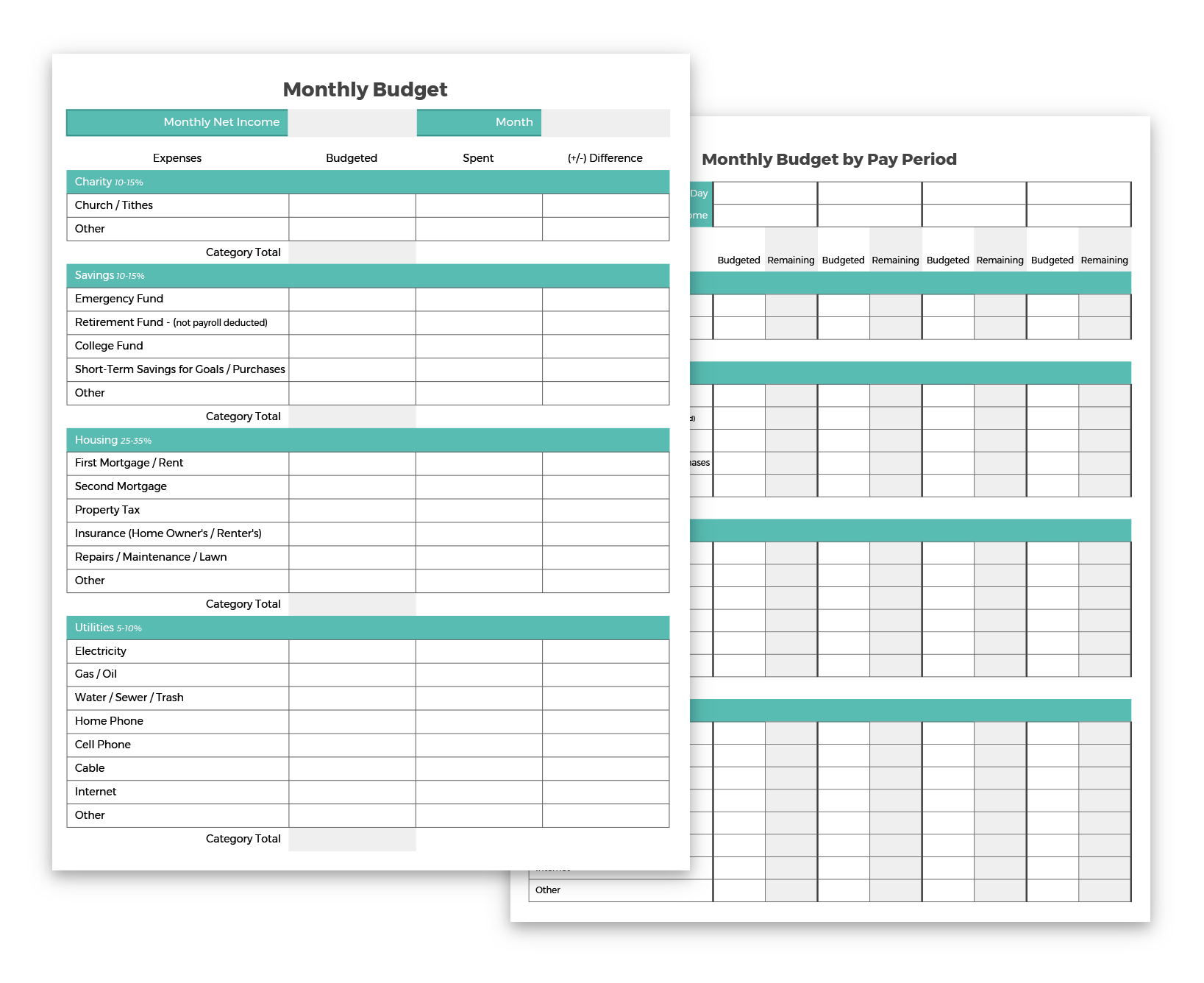

In this video, you’ll discover that everyone can budget no matter how tight things are, and you’ll learn the steps to take to get your budget started. After watching, be sure to download your free budgeting forms.

Download Your Free Budgeting Forms

To download your forms immediately, please enter your email address. You will also be subscribed to the weekly Hope+Cents newsletter.

Related Reading

• 20 Budgeting Tips to Help You Manage Your Money

• 5 Common Budgeting Myths

• How to Do a Zero-Based Budget

Prefer to read “How to Budget When It Feels Like You Have No Money”? Here you go...

Are you having a hard time figuring out how to budget because you live paycheck to paycheck and it feels like you can barely hold your head above water? If you feel this way, you are not alone.

You might feel like you don’t have enough money to budget and that the only way you can budget is if money is flowing freely.

Well, the irony of that thinking is that money will never flow freely unless you (you guessed it…) budget.

Everyone Can Budget

The only way to break out of the paycheck to paycheck cycle is to prioritize your spending. You will not wake up one day suddenly having enough money to cover your monthly expenses plus money left over. The only way to get to that point is to budget.

If you have any income at all and you have any expenses at all, then you can budget—regardless of how close those numbers might be. A budget is a map, guide, or plan for how you are going to spend the money you have coming in each month. It is simply an intentional plan for your money.

Everyone—even if you’re living paycheck to paycheck—can budget.

Steps to Budgeting

Okay, so how do you start budgeting? How do you budget when it feels like you have no money? Well, make the decision to just START. There is no need to wait for the stars to align. You can begin today.

Ideally, you would create your first budget just before the next full month begins, but even that is not necessary. If there are two weeks left in the current month, then create a budget for the next two weeks.

Let’s walk through the basic steps of budgeting.

1. Write it Down

For a budget to be effective, it must be written down. You can also use budgeting tools or software, but the point is your budget must be documented. You cannot have it floating around in your head. At the simplest form, all you need is paper and a pencil to budget.

Related Reading

• The Best Budgeting Apps (For People Who Don’t Like to Budget)

• 10 Reasons Why Your Budget Doesn’t Work

2. Start With Your Income

Add up all sources of income for the coming month (or the few weeks you may be budgeting for). So, if you work, your spouse works, and you drive for Uber, add up everything you expect to receive. Having this total is crucial to the process of budgeting. If your income fluctuates, do your best to estimate what you expect to earn.

Related Reading

• 50+ Ways to Make More Money When You Work Full-Time

• How to Make Money Doing What You Love

• 3 Ways to Handle Your Random Income

3. Gather Your Expenses

Now that you know what’s coming in, you need to look at what’s going OUT. Gather your current statements for all your bills and monthly obligations.

You will also need to know what you spend on non-fixed categories like groceries, gas, entertainment, and other flexible categories. If you have no idea what you typically spend in those areas, a good place to start is to take a look at your bank statements or credit card statements for the last three months and find the average of what you spend monthly.

Next, think about any additional expenses you will need to cover during the month (or again, the partial month, if you are starting mid-month). These are occasional, non-recurring expenses like a doctor’s visit, an oil change, school pictures, sports fees and others. Try to think of everything you will have on your plate for the coming month.

Related Reading

• How to Figure Out Your Spending For the First Time

• A Simple Step to Save Money on Your Monthly Bills

• How to Squeeze $500 Out of Your Monthly Budget

4. Spend Your Money on Paper

Going back to your total income that you’re expecting for the month, start “spending” your money on paper.

Identify the very first thing you will need to spend your money on, write it down, and subtract its cost from your income. The difference between the two numbers is what you have left to spend.

Then move to the next expense and do the same. Continue going through your expenses, prioritizing what must be taken care of. Do this until you have “spent” all your income. When the income is depleted, you stop spending.

This method is called a Zero-Based Budget.

Your Income – Your Expenses = Zero

Ideally, one of your expenses should be saving, however, if you are living paycheck to paycheck and this is your first attempt at budgeting, then your first pass at it may or may not show room for saving. Keep budgeting, though, and you will get there. You will be surprised to learn that prioritizing your expenses results in having more money to do the things you need to do.

Related Reading

• Why You Need A Beginner Emergency Fund

• 10 Hidden Budget Busters That Will Destroy Your Budget

5. Plan How You Will Spend Each Paycheck

Once you’ve gotten your budget to “zero,” go back and plan when you will cover all the expenses. List the dates of your paycheck and the amount you will receive for each check.

Keeping in mind the due dates of your bills, and the fact that you need to eat and put gas in your car each week, repeat the same process of “spending” your income on paper, but this time, you’re doing it for each paycheck. Spend each check down to “zero.”

This process puts your plan of how you want to spend your money into action. This step of breaking down your expenses by pay period is essential to budgeting successfully.

Related Reading

• 6 Things to Do With Your Extra Paycheck

• 3 Problems a Budget Can’t Fix…But You Can

Learning How to Budget Ends the Paycheck to Paycheck Cycle

Starting with these steps and sticking to them will move you out of the paycheck to paycheck cycle and towards having a firm grasp of where your money is going.

To dig a little deeper and learn more about how to budget, explore these additional posts about budgeting.

Have you been avoiding budgeting because you live paycheck to paycheck? Get started today!

0 Comments